ON DEMAND COURSES

Designed for flexibility and customization based on our student’s feedback, without sacrificing content quality and density.

Comprehensive online investment courses for those who cannot commit to 1 year long class and mentorship.

With Our Unbeatable Risk Free Guarantee

Join 12,900+ Students Who Have Taken Our On Demand Courses !

100% Refund If You are Not Fully Satifsied!

Start and finish at your own pace..

Based on feedback from our students, we designed the On Demand Courses for people who want to personalize their learning journey and only take the lessons that are relevant to them.

If the 1 year course and mentoring is too long, then this is for you. You can take it anytime and end it anytime, with no time limit.

We do not reduce the density of the content. You get the same quality content as if you were attending the class.

Mentorship? Group Chats? Q&A's?

Unfortunately, as this is an On Demand Course, mentoring, group discussion chats, and Q&As outside of the course are not included.

If one on one mentoring, group discussion chats, and Q&As are something you appreciate, we recommend the Investment Classes.

Our Investment Classes cover everything you need to master for stock investing. It’s a 1 full year of classes and mentoring support.

To ensure the best quality outcome for our students, we limit the number of students we can enrol for each class.

All of our 5 popular courses in 1 mega pack!

For limited time only, get the foundational principles of investment and leave nothing unturned with this bundle.

This for bargain bin price of $229 for ALL 5!

($416 OFF!)

More Courses to Come!

Join the Waitlist

And Receive 50% OFF

When A New Course Is Launched!

Bundles

Investment Mega Bundle

All of our 21 courses in 1 mega pack!

Get them all for $829 ($200 off*) and 100x your investment results with this bundle.

*Compared to buying 21 courses individually at $1,029.

Worksheets

Let me introduce you to our in-demand stock investment analysis checklist!

This checklist has been well received by our students.

We developed the SFA Stock Investment Analysis Checklist to assist our students to choose the best stocks and increase their investment returns.

(read more by clicking on the link…)

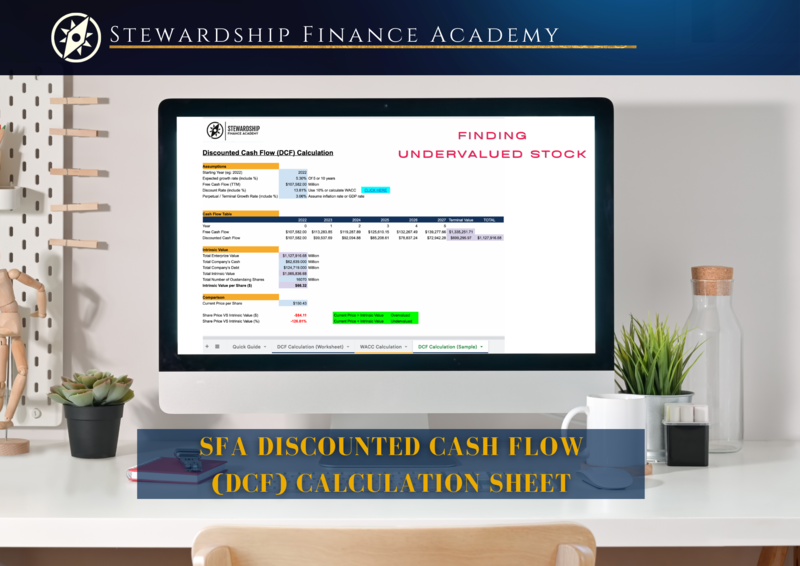

This calculator sheet finds the fair value of a stock investment based on the present value of its future income using 5 simple steps.

(read more by clicking on the link…)

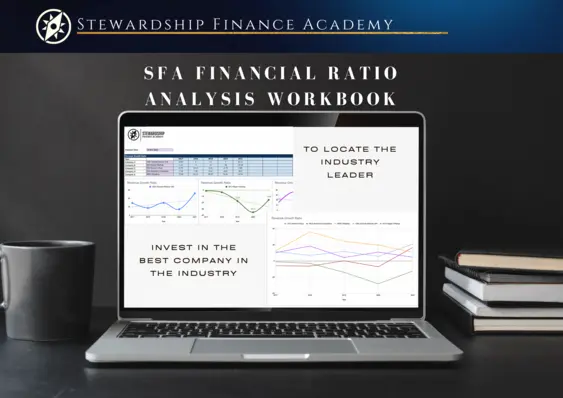

The important of Financial Ratio Analysis cannot be undermined by an investor.

This workbook is a powerful analytic tool for improving your understanding of company financial results and trends over time, as well as key indicators of company performance.

This workbook includes a simple scoring system for comparing up to five different company stocks in order to choose the best stock to invest in.

Courses

Successful investing involves making choices that meet your unique needs today, meet your financial goals for the future, while also weigh in your circumstances.

A smart investor would master these principles and know it by heart.

Unfortunately, investors can get caught up in details or they can become intimidated by some investments that they lose sight of these core principles.

For that reason, this course will help new investors be grounded in the success principles and support as a refresher for even the most experienced investor.

(read more by clinking the link…)

Have you ever wondered why do you need a broker to make trades on your behalf?

Were you aware that each stock has two prices? That you can’t buy and sell for the same amount?

OR

Why and how does a company issue shares?

What is an Initial Public Offering (IPO)?

What is a stock exchange?

How share prices are set?

How is money made from the stock market?

Evidently, very few people around the world invest in the Stock Market…

This lesson walks you through the basics of every aspect of the stock market, terminologies, and investments so that you have a breadth of knowledge when making your first trade.

(read more by clinking the link…)

Value investing is the powerful strategy which the greatest investors of our time, like Warren Buffett, Charlie Munger and Seth Flarman, use to earn billions on the stock market.

Value investing is a proven strategy that reduces investment risk and provides high profits for those who do it right.

In this course, you will learn how value investing works and the principles you must adhere to do it right.

(read more by clinking the link…)

Stock investors face difficult decisions when investing money.

Examining the massive amount of data available can be time-consuming. Fortunately, we have done all of the legwork for you.

In this stock investing course, we examine Warren Buffett’s four investing rules and the eleven stock investing criteria used by the Stewardship Finance Academy (SFA) to select fundamentally sound companies for investment.

Unlock the secrets of financial statements effortlessly in “Mastering Financial Statements The Easy Way: Your Gateway To Profitable Stocks.”

This course is essential for anyone seeking to thrive in the stock market by demystifying financial reports and making informed investment decisions.

Elevate your personal and professional growth as you grasp key financial metrics, interpret statements, and identify lucrative stocks confidently.

Throughout the course, you’ll delve into income statements, balance sheets, and cash flow statements, equipping you with the expertise to maximize your profits and achieve financial success in the dynamic world of stocks.

Unlock the power of smart investing!

Take this course to discover how analyzing profitability ratios, dividends, and cash flows can supercharge your financial acumen.

This course isn’t just about stocks; it’s your path to personal and professional growth.

Learn to spot promising investments, make informed decisions, and gain a competitive edge in the market.

Dive deep into financial metrics and create a roadmap for your investment success.

Don’t miss this chance to boost your financial IQ and shape your future.

One of the common mistakes that investors run into is blindly following what other investors do (copy trading.. sounds familiar?)

If this is you, the moment you are left on your own, the good time may come to an end. The missing piece of the puzzle to the performance is the mindset.

Those successful investors made the investment for some reasons. If you are not able to understand the reasons that lead to the investment, you are not able to carry out the process on your own.

Until you can manage your mind, do not expect to manage money.

Whether you listen to financial mentors, trainers, or successful entrepreneurs, they all say the same thing: Your mindset contributes 60 to 90% to your success (only the actual number varies, depending on whom you ask). The rest is mechanics and knowledge.

(read more by clinking the link…)

Learn to assess company stability, avoid bankruptcy risks, and make informed investment decisions.

Gain practical skills with ratio analysis and real-world examples. Secure your financial future today!

(read more by clicking the link…)

A crucial skill endorsed by Warren Buffett himself.

Learn to identify vigilant leaders who can significantly influence a company’s share price and your investment returns.

(read more by clicking the link…)

Everything you need to know in one course to understand the types of mutual funds such as open-end and closed-end funds, funds of funds, target date funds and the pros and cons of these funds.

You will learn how the value of the fund is calculated and how the funds work. You’ll also learn about the hidden mutual fund fees and how to avoid them.

Discover how to invest in index funds and ETFs. Learn what to look out for, such as tracking errors and 9 methods of evaluating funds, including using Morningstar’s rating and style box.

We also cover locally and internationally domiciled ETFs, hedged and unhedged funds, and their tax implications.

(read more by clicking on the link…)

Smart stock pickers have three big things in common:

1. They have decided in advance what they want to achieve with their portfolio, and they are committed to sticking with it.

2. They stay abreast of the daily news, trends, and events that drive the economy and all the businesses that make it up.

3. They use these goals and economic insights to make their decisions about buying or selling stocks.

In this lesson, you will learn how to achieve the numbers 1, 2, and 3 as well as building a good investment habit.

(read more by clicking on the link…)

How can we manage our risks when investing or trading in financial markets?

As humans, no matter how intelligent we are in terms of mathematical calculations etc, most of us still fall prone to psychological traps and end up making emotional-driven or irrational decisions and mistakes in the financial markets, all of which can wreak havoc on our investment portfolio.

This course will complement your investment knowledge with the understanding of market psychology and human behavioural biases, so that you can avoid making the typical investment mistakes that cause most investors to incur losses repeatedly.

It will also help you to understand yourself better – whether you are more suited to become a trader or an investor, and enable you to reflect on your past investment decisions and how you can improve your investment approach and strategy.

You will also learn the practical ways to manage your risks and craft your own risk management plan accordingly.

(read more by clinking the link…)

What is Technical Analysis? Many years ago the subject was called chart analysis or charting. The “technical” was added later.

Experienced chart readers can discover a lot more when they read the stock charts.

Subtle clues in price and volume movements can tell you many things, including whether the stock is:

– behaving normally or abnormally,

– falling out of favor with institutional investors

– beginning or ending of a price advantage

The charts cut through the rumors, headlines, and hype to paint an unbiased picture of what’s really going on with the stock.

Using charts to predict future price movements applies not only to stocks but also to bonds, currencies, cryptocurrencies and commodities.

If you want to base your investment decisions on the price change and the strong market trend, knowing Technical Analysis is a must.

(read more by clicking on the link…)

Drawing good trend lines is one of the most rewarding skills to identify buying and selling opportunities.

Discover James Lim’s secret for selling at the start of the 2020 pandemic stock crash and buying back at the bottom of the market using the trendline strategy.

Learn how to use this simple yet powerful tool whether you’re trading stocks or investing in cryptocurrency.

Bitcoin has received a lot of mainstream attention lately due to its spectacular returns, especially in 2020.

Many people blindly invest in cryptocurrencies hoping to make quick money and then lose money and get scared, while some think that cryptocurrencies are just a scam aimed to cheat retail investors out of money.

So two sides battle: those who believe in it and those who don’t.

This lesson is not for the faint of heart, and it will shatter all presumptions on both sides.

(read more by clicking the link…)

Learn the art of valuation ratios, a key tool used by legendary investors like Warren Buffett and Benjamin Graham, to identify undervalued stocks.

Master the P/E, P/B, and P/CF ratios etc to assess company value.

Understand how to compare companies within industries.

This course demystifies complex financial concepts, making them accessible to individuals eager to select the right stock at the right price.

(read more by clicking on the link…)

If you’re intrigued by the intricacies of the global currency system and its impact on the economy…

If you’re seeking clarity on the difference between money and currency and how it shapes our financial understanding…

If you’re curious about how historical monetary systems evolved and led to our current economic structure…

If you’re concerned about inflation and its silent erosion of wealth and purchasing power…

If you’re interested in safeguarding your financial future by understanding the forces that drive economic inequity…

If you’re eager to learn how to position yourself advantageously in a world of shifting economic paradigms…

…ihen this course is for you

(read more by clicking on the link…)

Gain the knowledge and tools needed to excel in trading.

Our course covers everything from basic order types to advanced strategies like short selling and trading the breakout.

Whether you’re new to trading or looking to refine your skills, this course offers the insights needed to succeed in today’s markets.

Learn how to calculate a company’s intrinsic value and make smarter investment choices with confidence.

This course distills the complexities of the DCF model into an accessible format for newcomers. You’ll understand the “why” and “how” behind one of the most trusted valuation methods used by professional investors.

Ideal for beginner to intermediate investors who want to move beyond basic financial ratios and gain deeper insights into company valuation.

By the end of the course, you’ll confidently analyze company fundamentals, project cash flows, and calculate intrinsic value—empowering you to identify undervalued stocks.

Start your journey toward smarter investing today and uncover the secrets of DCF!

Free Guides To Start Your Investment Journey

A step-by-step guide to planning your goals and investments so you can gain clarity and begin investing right away!

Discover the secrets of cryptocurrencies that will shatter all presumptions on each side: Those who swear by them and those who avoid them like the plague

Read Our Blogs!

Our investment and trading expertise in written form.

Go to the blogs to pick our brains on wide issues about investment & trading

How To Manage Stress While Investing, And Also PROFIT? Follow This For Stress FREE Investing!

“This simple method allows my mental health to be unaffected by price fluctuations, sleep peacefully at night, avoid burnouts, while also making profit.”

How I Buy a $1 Million House at a 15% Discount in 2023!

I’ve personally bought 4 properties in the span of 4 years. I will explain how I have done it PLUS how to get good houses at a discount. Read this..

What Values to Use for PE Ratio : The “No Bullshit” Best List

A list of P/E ratios you should put in your stock screener, plus a guide as a bonus No bullshit. Go and read now.

How ASX Investors Can Build $1 Million Portfolio in 6 Steps With Just 1 Stock

A step by step guide on how to build a “set and forget” $1 Million portfolio. Most of my students set this up in their 1st year. Have you done it?

Stock Market Risks – A Guide to Stop A Company’s Liquidity Risk from Wiping You!

The company that you invest in can go kapoof at any time with all of your money. Read through so you will know your stocks are safe from these companies.

The Best Guide on Free Cashflow You Will Ever Need

So, you want a company that give great year on year returns? Pays good dividends? Has enough liquidity to lasts forever? Read this!