Welcome to the exciting and unpredictable world of stock investing!

It’s a world ruled by two powerful emotions: fear and greed.

Fear of losing money and greed for more profits can drive investors to make rash and emotional decisions that can be detrimental to their portfolios.

However, as a savvy investor, you can learn to keep these emotions in check and make rational investment decisions.

Warren Buffett knows all too well the dangers of irrational exuberance. In 1987, when the market was soaring to new heights, he warned investors of the dangers of a bull market [5].

He saw that investors were being overly optimistic and buying up stocks left and right without regard for their actual value. And what happened? “Black Monday” hit, and the market crashed, wiping out billions of dollars in wealth.

Navigation

Warren Buffet's Advice On Fear And Greed

Warren Buffett’s famously said, “Be fearful when others are greedy and greedy when others are fearful.”

Essentially, when the market is booming, and everyone is jumping on the bandwagon, that’s when you should be cautious.

When everyone’s buying, prices go up, and things get expensive. And when things get too expensive, they’re bound to come crashing down.

Therefore, when the market is bullish and everyone is buying, it’s better to be cautious and consider selling.

Conversely, when the market is bearish and everyone is selling, it’s better to be optimistic and consider buying.

Good news is, there is a metric called Fear and Greed Index that encapsulates this principle.

Fear And Greed Index : A Valuable Tool for Smarter Investing

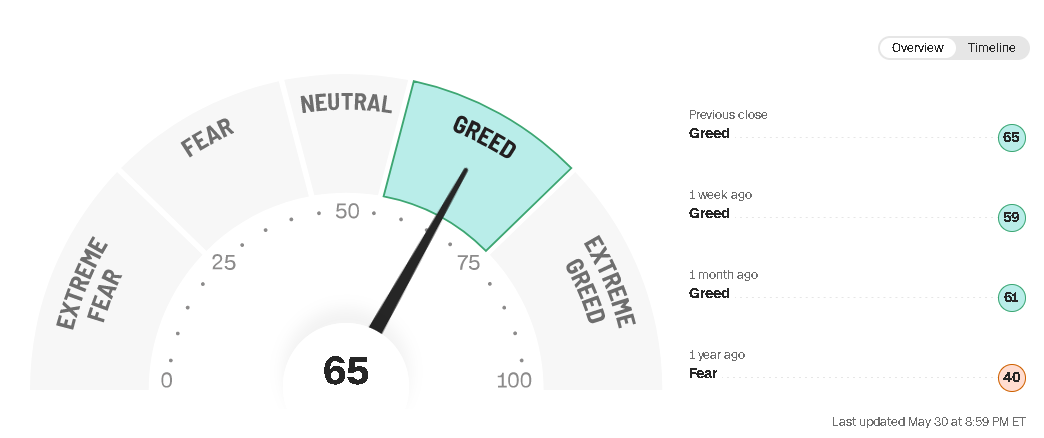

The Fear and Greed Index is designed to measure investors’ emotions of fear and greed based on factors like stock price movements, trading volume, and market trends.

You can find the Fear and Greed Index on popular financial news websites like CNN Money, MarketWatch, and Yahoo Finance.

The index uses a scale of 0 to 100, with a reading above 50 indicating that investors are more greedy than fearful, and a reading below 50 indicating the opposite.

If the index shows a high level of fear, it may be a good time to buy undervalued stocks that are oversold.

Conversely, if the index shows a high level of greed, it may be a good time to sell overvalued stocks that are overbought.

However, it’s important to note that the Fear and Greed Index should not be your sole basis for making trading decisions.

It’s essential to conduct your own research and analysis before making any investment decisions.

By using a combination of Warren Buffett’s proven approach and the Fear and Greed Index, you can make smarter investment decisions and potentially see big profits like Warren Buffett Berkshire Hathaway.

QUICK WIN

Access the Standard Fear and Greed Index here

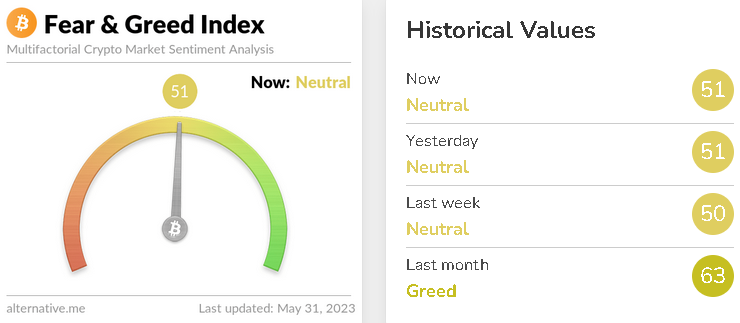

If you are in crypto space, the Fear and Greed Index for those can be accessed here:

And remember The Rule:

Fear = Time to Buy Undervalued Stock

Greed = Time to Sell Overvalued Stock

Use standard metrics (such as DCF Analysis, P/E ratio, P/BV ratio, P/EG ratio, and others) to determine whether the stock is undervalued or overvalued before you do a buy/sell action.

Never Forget Other Financial Ratios Too

Fear and Greed Index is just one amongst many other tools used for investment.

A person may decide its a good time to buy/sell now based on the index, but does they know how to analyze stcok whether its overvalued or undervalued?

Warren Buffet famously said that when he invest, he is investing in a business, as if he is the one owning it and running it.

Because that is what investment is, you invest in the business.

A good solid business will run far and very profitable. A bad business will burn to the ground, and burn your money away with it.

Therefore, lots of work are done in the beginning, BEFORE we put our money into a stock.

A company needs to be analyzed whether its profitable, have great track record, great future growth, helmed by competent management team, great liquidity, etc.

That is why I developed SFA Investment Class.

A one-year guided class and mentorship in which you learn about all the important criterias, and how to use them so that you can start seeing REAL results.

You’ll have:

- In-depth stock investment knowledge that leaves no stone unturned.

- One-on-one mentoring that will guide you through the entire process.

- Action Plans for applying what you’ve learned to your real-world investments.

- Practical Tips.

- Weekly update of current economic and investing insight.

Furthermore, my team will add you to a private WhatsApp group where you will meet others in the same situation as you, as well as have access to mentors and group discussions.

You owe it to yourself to check out the SFA Investment Class >>

I guarantee that within the first two months, you will feel far more confident about your investments, and have a solid plan in place to achieve your financial objectives.

I’m looking forward to seeing you in class.

James Lim

SFA Founder

Member of Australian Investors Association (AIA)

The University of Queensland Speaker