Most people rely on social security in their later years. In Australia, a minimum of 9% of a person’s income goes to their superannuation fund. According to the U.S. Department of Social Security Administration in 2016, the poverty level for a family of 4 is $25,000 per annul. However, the average monthly payout currently hovers at ~US$1,300/month for retired workers and ~US$1,100/month for disabled workers.

This trend highlights that if a person’s retirement is purely reliant on their social security, it will not be sufficient for one to enjoy a routine middle-class lifestyle. A single unexpected expense could lead to disaster. Furthermore, it is almost impossible to handle the costly medical needs for pensioners.

Another bad news, while the government does increase the benefits every year, it will never be enough to offset inflation rate. Hence, buying power only goes downhill, and never goes up. The same loaf of bread that cost $1 today will double for every 20 years. By the time you retire in about 40 years, it will cost you $4 per loaf.

And that is just bread, not counting other food items, bills, and of course, health-insurance. Health care costs have risen at a tremendous rate, that your monthly health insurance would easily be larger than your mortgage payments, in a couple of decades.

So, what would be the way out? Investments!

Given decent planning, investment can take us out of the doomed pathway of poverty-stricken income levels in our later years. We don’t have to depend on social security being forgiving on us.

Also, the nature of investment would give us the power to control over future returns that would guarantee us $1 million!! Don’t believe? Compound interest gives us that possibility. Read on below…

Compounding Effect

The concept of compound interest is not difficult. Compound interest is defined as interest on an initial investment that earns extra added interest overtime. It is where the investors earn the extra interest on top of their initial investment interest. Although the interest rate may be fixed, the interest earned on the money is not; it gets larger, depending on the amount of time that has passed.

Compound Interest vs Simple Interest – The Road to $1 Million

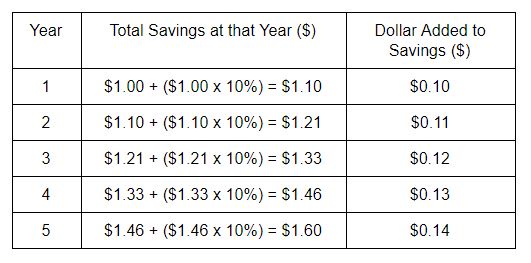

To demonstrate, let’s review an example: You have $1 in your savings, and your interest on that saving is 10% per annum from your overall investment avenues. Let us see how it grows yearly, until the 5th year:

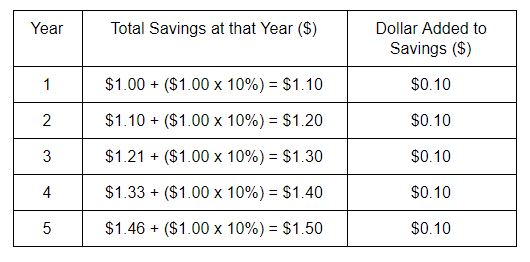

As you can see, after the 5th year, the $1 is multiplied by 1.6 times. This is different than simple interest, where each year, the dollar added is only $1 x 10% = $0.10 per year.

With simple interest, the $1 is multiplied by 1.5 times after the end of the 5th year, instead of 1.6 times by compound interest.

This difference highlights one property of compound interest, that “earnings” on your dollar (dollar added per year) is far more important than the first invested dollar (called the “principal investment”). Also, it shows the structure of compound interest, that total savings on any given year (S), given a percentage interest (I) and a principal investment (P) can be calculated by:

We will refer to this as proof that $1 million goal is not a far fetched idea.

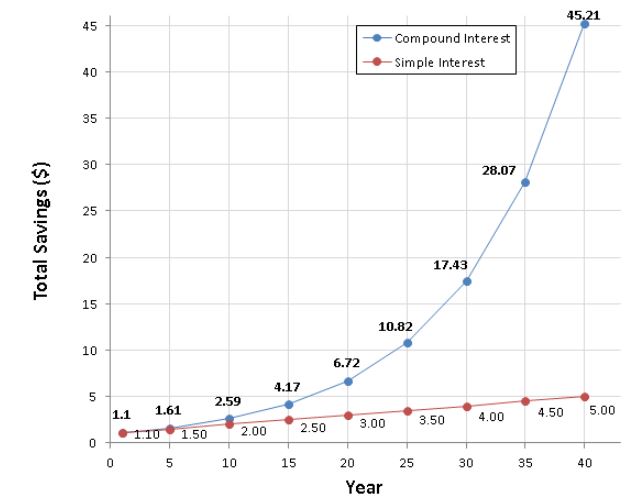

Continuing on to demonstrate further, 1.6 vs 1.5 might not be that much of a difference, but over longer timeframe, say 40 years, it becomes stark:

With only $1 of investment at 10% return rate, it gives $45.21 return after 40 years! It is clear that compound interest provides a comparatively massive rate of return, starting from the 15th year. You can replace your original $1 savings with $10,000, and that will become $452,100, nearly half a million dollars over 40 years! That is just by letting the money stagnate with 10% compound interest, little to no work required!

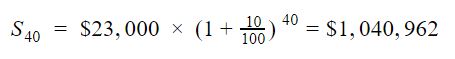

Now it is a good time to refer back to the compound interest formula to answer the literal million dollar question; How much principal investment is needed with 10% p.a. over 40 years to reach the $1 million mark, for a person to retire comfortably? ~$23,000 is all you need.

We hope that by showing you this, you will see that to have $1 million of “social security” through investments is not a far fetched idea at all. However, there is more to it. A 10% p.a return may be an ideal number, but also slightly unrealistic. A 9% figure is more close to reality. The adjustment needed will be discussed in the next two section.

Effect of Diversifying Securities

The power of compound interest is that a small change in interest rate will greatly influence future results. Even 1% of difference in interest rates can snowball into hundred thousands of dollars difference down the track. This affects two important things: the investment type and our planning.

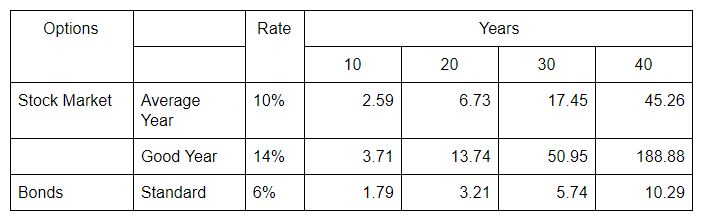

To see this, let’s have a look of the typical returns of two investment securities; stock market and bonds, over X amount of years:

Using the last results, if you have invested $23,000 as a principal, by the end of the 40th year, the average stock market performance would give you $1,040,962 (from $23,000 x 45.26), whereas a standard bond would give you $236,670 (from $23,000 x 10.29). That is a huge difference of ~$750,000, with just 4% rate between the two (10% vs 6%). You can see that where you invest your money affects your returns greatly.

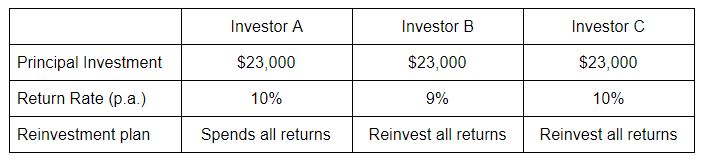

What about if it is only 1% difference instead of 4%? Also, what if a person wants to take some of the returns back to spend? Let these be illustrated with another example; Investor A, B, and C put a $23,000 principal investment into the stock market, but with different return rates, and also different re-investment plan.

Investor A would spend all returns, and hence, his investment grows in a simple interest fashion. However, B and C would keep the returns and reinvest it; their investment grows in a compound interest fashion. One important thing to remember is that compound interest only works if you plan to reinvest ALL the returns.

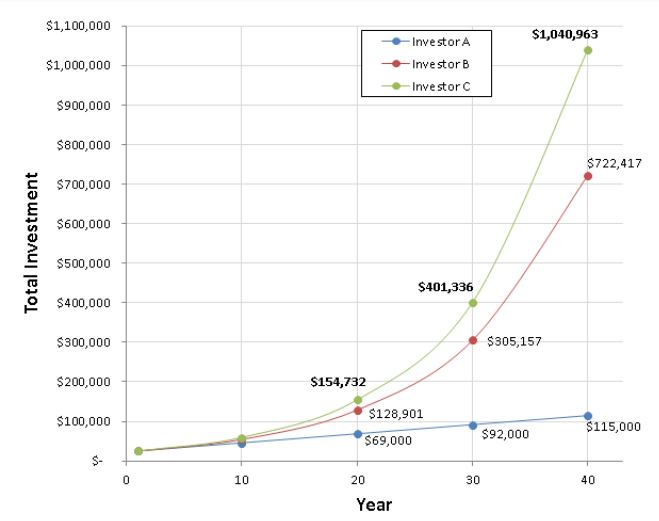

By looking at the table, B would have less return at the end than C, as the interest rate is lower (9% vs 10%).

From this figure, Investor B would have pocketed ~$300,000 less than C, over the 40 year period. Although this is smaller than the previous ~$750,000 difference, it would still hurt the retirement plan in the long run. So, depending on the amount of the principal investment, any small difference in interest rates is potent enough to hurt or boost investments.

This is also true for mortgage and credit card debts repayments planning. Be wise in choosing the interest repayments that you have to pay. Remember, 1% difference can cause enough hurt in the long run. Always pay your debts early to stop it from growing with time.