How do you safeguard your financial security? Are you just like the majority of people who keep a sum of money in the bank account for emergency or future needs? Do you know that keeping your money idle is actually very risky? Not to mention that one or two bad incidents may finish or use up your saved money. Money in the bank loses its buying power over time due to inflation.

Inflation is the persistent increase of price for general goods and services, that causes the decline of money value over time. It is a hidden thief who steals your hard-earned income bit by bit without concern. A penny here or a penny there is hard to notice over a couple of months but when you look back over the past 40 years it is surprising how much prices for normal everyday type of goods and services have increased.

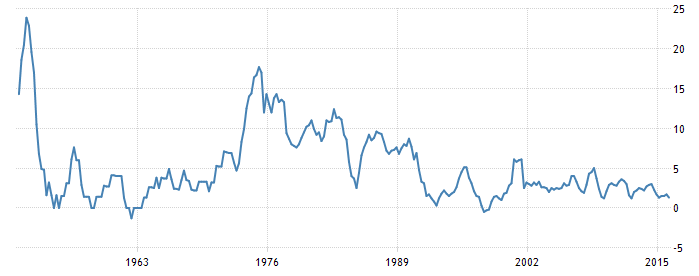

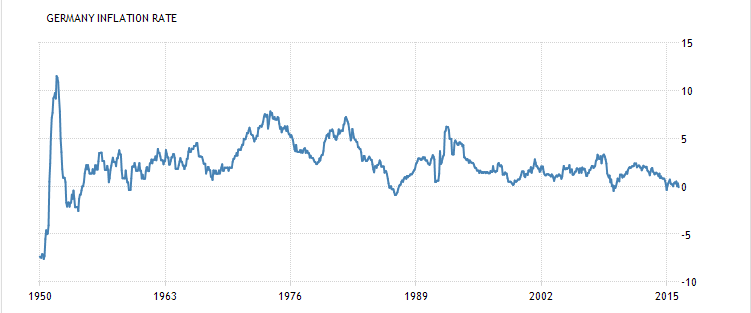

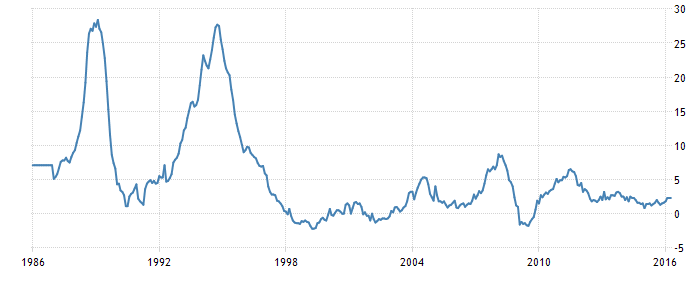

In recent years, inflation has been kept around the 2% – 4% range in most of the countries, but checking on the historical inflation rates even in the developed countries like Australia, Germany and China, from the charts below you can see that annual inflation rates have been as high as 20%!

Australia Historical Inflation Rate(1951-2016)

source: www.TRADINGECONOMICS.com | AUSTRALIAN Bureau of Statistics

Germany Historical Inflation Rate(1950 – 2015)

source: www.TRADINGECONOMICS.com | AUSTRALIAN Bureau of Statistics

China Historical Inflation Rate (1986 – 2016)

source: www.TRADINGECONOMICS.com | AUSTRALIAN Bureau of Statistics

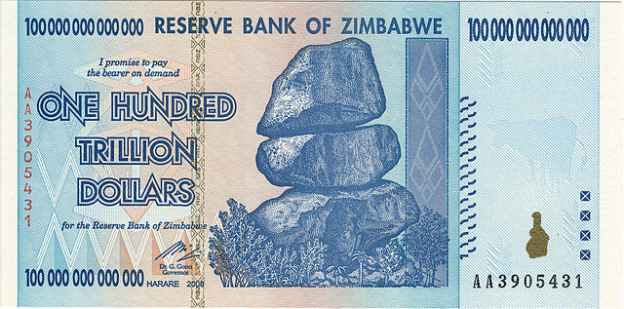

The largest denomination of a Zimbabwean banknote ($100,000,000,000,000)

Cruel facts of inflation

According to Reserve Bank of Australia, an inflation calculation for a same basket of goods and services valued at $100, 40 years ago, would require $600 in 2017 to purchase. In other words, the value of money has dropped 83% over 40 years! While for the US, they have experience a 76% of decline in money value over the same 40 years. Just because inflation has been around 2% in the recent past, doesn’t mean it will stay that way in the future.

How to deal with inflation

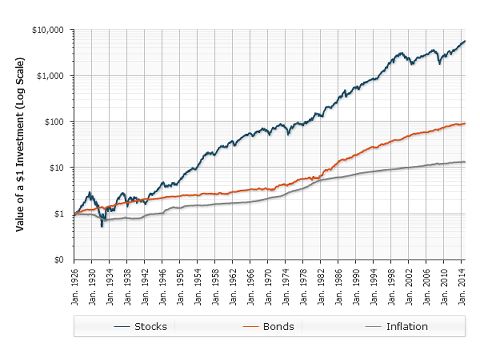

To beat inflation, you need to find some type of income producing asset that will grow in value over time. Getting interest from your savings money in a bank could be one of the option. However, the rate of the interest might be lower than the inflation rate. As far back as financial records go, the stock market has increased in value and outpaced the rate of historical inflation.

Total annual return of Stocks and Bonds, and Inflation

source:https://us.axa.com/

The Role of Federal Reserve

The Federal Reserve is the banker’s bank providing financial services to financial institutions and assuring the national financial system. Just as the regular bank provides banking service to individuals, the Federal Reserve provides banking services to banks. It is also the government’s bank that helps managing the revenue from tax and the government expenses. The government securities such as bonds, treasury bills and notes are all handled by the Federal Reserve. The Federal Reserve and all other central banks around the world were created with a mandate to maintain price stability for goods and service. It is a role that regulates and supervises a nation’s finance system.

It is part of the Federal Reserve’s roles to maintain price stability by targeting a 2% annual inflation rate. Various monetary policies will be implemented to bring up the inflation rate whenever it drops below the targeted level. This also means that inflation is basically pre-programmed into our way of life. There is really no practical way to avoid inflation.

Therefore, the only way to safeguard your financial wealth is to invest into something else that would generate for you an income higher than the inflation rate.