We have learnt about the different types of markets and stocks but how can you actually make money with a stock? In a brief summary, as Benjamin Graham once wrote, “ All the real money in investment will have to be made—as most of it has been in the past— not out of buying and selling but out of owning and holding securities, receiving interests and dividends therein, and benefiting from their long-term increases in value.” In this article, we will do an introduction on the number of ways that money can be made with a stock.

Cash Dividend

The goal of any company is to earn profit. Once it has generated profits, the Board of Directors will decide whether to distribute the profits to the shareholders. This profit is what we call dividends. Each of the companies has its own dividend policy and payment dates. The cash payment cycle can vary from monthly, quarterly, to twice a year or once a year.

The amount of payment you receive is based on the number of shares you own and the DPS ( Dividend Per Share) or dividend yield. Assuming you own 1000 shares bought at $50 per share of a company which equals to a total of $50,000 investment. The 1000 shares is your share of dividend distribution. When the company has enough retained earning and cash, the directors will decide how much of a dividend is given to the investors. If the directors of the company declare an annual $5 per share cash dividend distribution, you will receive $5000 in cash dividend for your continued investment. Assuming your share value has not changed in a year, your investment will now be worth $55,000 ($50,000 initial investment plus $5000 dividend). Even if the share has dropped to $45 per share after a year, your investment will still break even at $45,000 (share value) + $5000 (cash dividend) which is $50,000.

What is dividend yield or annual yield? Dividend yield is the annual dividends per share divided by the price per share. In our previous example, taking total dividend amount $5000, divided by the total investment of $50,000, gives us the dividend yield of 10% . When the price of the shares increases, the dividend yield drops. For instance, if you purchase 1000 shares at $100 per share and the cash dividend remains unchanged. The yield would be 5% instead of of 10%.

An established or stable company with a good history tends to provide higher dividends to its investors. On the other hand, a higher growth company issues lower dividends due to the reinvestment of profit for company growth.

Dividend Reinvestment Plan (DRIP)

Under the dividend reinvestment plan (DRIP), the company offers the investors the option to reinvest their cash dividends by issuing additional shares or fractional shares to them. Investors perceive this as a good opportunity to boost the value of their investments. Firstly, since the new shares purchased are issued directly from the company and not from the brokerage firm, it is free from commission fees. Moreover, it gives the investors the benefit of compounding because as the dividend issued is used to purchase more shares, each time the subsequent dividend issued will be more than before. The best part is that most companies offer their shares at 3-5% below the market price to purchase the additional shares. Sometimes, it can go up to 10% depends on the company.

Let’s take for example, that you have 1000 shares in the company and decide to re-invest 100 percent of your shares in the company’s dividend reinvestment plan. The shares you are holding are currently trading at $50 per share in the market. If the company declares to pay a dividend of $2 per share, you will receive $2000 in cash dividends. Also, the company’s DRIP offers a 5% discount to buy the additional shares at $47.5 per share. Since you have decided to take 100% participation in the plan, you will receive 42 shares instead of $2000 in cash. Together with the initial shares, you are now possess 1042 shares in total.

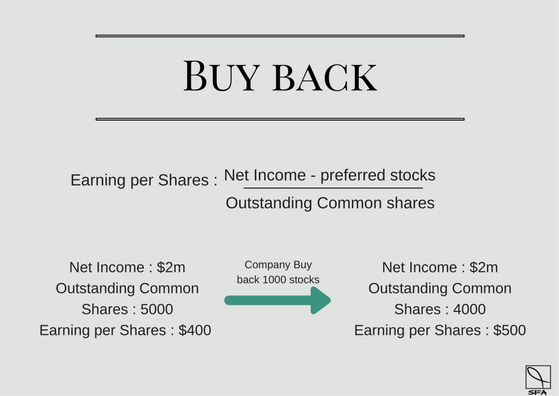

Buy Back

Buy back which is also known as share repurchase is the re-acquisition by a company of its own stock from the shareholders. Why would a company buys back its own stock? Stock buyback will reduce the supply of shares in the market and thus increase the share value. It is done also to eliminate the risk of stake controlled by shareholders.

The main reason is all about supply and demand. For example, a company has 5000 shares and each share is worth $1000 on the market. The company decides to buy 1000 shares to reduce the supply in hope that the demand of the remaining shares will increase. By reducing the supply, the value of the remaining shares will now increase as the investors will see the reduced share price as a bargain. The company wants to send the idea to the market that the shares are undervalued and should be trading at a higher price. By doing so, the EPS (earning per share) for the rest of the shareholders will increase due to the reduction of the outstanding shares.

Please refer to the calculations in the diagram, the formula of EPS is the total of net income minus preferred stocks divided by the number of outstanding common shares. From the example we can assume that there is no preferred stocks in the company and the net income of the company is $2 million. With the formula given we can conclude that earning per stock when the company had 5000 shares was $400. And it increased by $100 with a total of $500 after the repurchase.

Bonus Share (Bonus Issue)

Bonus share is often known as bonus issued. It is an event where bonus shares are issued to the shareholders on top of their existing holding of shares in the company. Bonus issued often occurs when the company has sufficient reserves and has not paid out as dividends. Bonus issue will decrease the reserved capital but increase the liquidity of the stock and bring the share price to a fair price range.

Bonus shares are usually given out in a predetermined ratio. For example, if you hold 100 shares of a company and the board declares a 1:2 bonus shares distribution, you will receive another 2 shares for every shares you own. Therefore, you will receive 200 free shares and the total shares holding would be 300. The increase of outstanding shares in the market often leads to the share price fall. The company equity is now diluted and the stock is now more liquid. With the same amount of profits generated by the company, the EPS (Earning per share) will decline which will lead to a decrease of share price. Nevertheless small retail investors will be attracted to invest into the company since the price is now cheaper. Bonus issue is often viewed as a positive signal showing the company’s capacity to serve a larger equity base. The management is said to be confident to serve the larger equity by increasing the future profits and dividends distribution on these issued shares in the future. Since bonus shares are distributed by capitalizing the free reserves of the company, the share capital of the company will increase. Despite the increment of the total shares of the company, the face value of the shares remains the same.

Stock Splits

In a similar way of bonus shares, stock split increases the numbers of outstanding shares without affecting the company capital. It commonly happens when the price of the share is too high and expensive.

Stock split is like cutting your cake into pieces instead of being given additional cakes. The total value of your investment remains the same due to the reduction of share price after the splitting. For example, if you hold 100 shares of a company traded at $100 per share and the board decided to declare a 2 for 1 stock splits. In this case, you will now own the total of 200 shares of the company. A stock split will increase the quantity of shares (liquidity) but results in a price per share drop. The idea is to make the shares seem more affordable to investors but in actual fact the market capitalisation of the company has not changed. Contrary to bonus share, the face value of the shares will split into half in this case.

In summary of comparison, bonus share is a free additional shares distribution while stock splits is splitting the same shares into more units. Both bonus share and stock splits do not increase the value of the company. Bonus shares will decrease the reserve capital as it is used to create new shares. On the other hand, stock splits will result in the reduction of face value of shares. As both bonus issued and stock split make the shares affordable as the result of the price reduction, this will eventually increase the demand and drive up the share prices.

Capital Gains

Capital gains is when you sell your stocks or any securities at higher than the purchase price. For instance, you purchase 10 shares with total of $500 and sell it at $700, therefore, your profit would be the difference which is $200. Capital loss, on the other hand, is when you sell your stock at a price lower than $500 in this situation. However, you will not pocket all profits as you would trigger capital gains tax. As the name suggests, capital gains tax (CGT) is a tax on your capital gains and it is part of your income tax.

As you can see there are plenty of ways that money can be made with a stock, if your investment is done right, you can let money work for you! If you would like to learn more with more depth, I invite you to subscribe and follow us.