The title is real.

I will guide you step by step on how to build $1 Million portfolio with no fillers and no bullshit.

As an added bonus, you don’t even need to “watch” the stocks daily.

Just set it and forget it.

Watch and take action only when there is an economic downturn.

Read on below.

Navigation

STEP 1: Select Just One Stock

For the method to work, we need just 1 stock that meet the below criterias:

- Available Locally

- Have ROI of at least 9%

- Have Fees below 1%

- Have existed for at Least 10 years

- Will not be delisted for any reason, including due to economic downturn

The quick answers to the above are index funds, e.g basket of stocks that tracks major indexes such as S&P500, S&P200, ASX200, Hang Seng Index, etc.

Normally, the big investment funds such as Blackrock and Vanguard have packaged that into a product called Exchange Traded Fund (ETF).

Essentially, ETF’s are a bag full of stocks, where you can buy, sell, and track its price.

The one that creates the bag e.g Blackrock or Vanguard, will charge a “bag fee”, similar to how your supermarket charges plastic bag on top of your groceries.

We want this fee to be as low as we can, at least below 1%

Standard ETF’s that people selecting are the ones tracking S&P500, the biggest and baddest 500 US companies.

These are:

Find the ETF’s above that exist in your local stock exchange and note it down.

*expense ratio is the “bag fee”

STEP 2: Choose The Funding Regime

To fund your investment, you need to consider a funding regime.

Do you put a lump sum to buy the ETF? or a regular fund transfer (e.g weekly)?

Which one do you think is best? See below.

LUMP SUM PAYMENT

BEST for returns, BAD for money management.

The normally fixed brokerage fee (say $3 per trade) is insignificant compared to the money invested.

With a $1,000 lump sum, $3 brokerage fee is only 0.3% of the total investment (Fee is less than 1%)

However, you need an excellent self-control to NOT spend the lump sum on other things as it builds up in your bank account.

REGULAR PAYMENT

BAD for returns, but BEST for money management.

The normally fixed brokerage fee (say $3 per trade) will eat the returns significantly.

Assuming a person sets up $70 weekly payment to buy the ETF, a $3 fee is 4.28% of the total investment.

E.g. You are paying a house mortgage at 4.28% interest rate, compared to the 0.3% earlier. It is a SIGNIFICANT difference

However, this regime will automatically invest your money weekly out of your bank, which eliminating the risk of YOU spending it on other things.

STEP 3: Register to One Low Fee, CHESS Brokerage

If you are new to investing, you might be shocked that you can’t just buy a stock or ETF by yourself.

You must go through an “investment broker”, “broker”, or “brokerage” to do so.

Similar to getting a car, you must go through a car dealer to get a car.

When selecting a brokerage, make sure that they:

- Have access to the shares and ETF’s that you want

- Have tools to accomodate your funding regime (lump sump, regular, etc)

- Are CHESS-Sponsored

LOW FEES

A low fee brokerage is a must since fees can really eat it into your returns.

Luckily, there are plenty of comparison sites to find them.

A simple google search of “cheapest brokerage [insert your country here] ” would net you those comparison sites.

For example, this is the list for the Australian market>>

CHESS-SPONSORED

CHESS Sponsored means that when you buy the stock / ETF, the stock exchange will issue you a letter, put you into their system, and record how many shares you own.

This gives you a full ownership of the stock, e.g. you can buy, sell, change to a different broker at your leisure.

Compare that to NON-CHESS, where your broker are the ones who manages your share ownership e.g broker have control over your shares.

If the NON-CHESS broker goes under, you might lose all your money.

Note that CHESS Sponsored is an Australian term! The generic term would be “non-custodial”

In essence, register to a non-custodial brokerage (list for Australia is here >>)

STEP 4: Set Up An "Easily Accessed" Stock Watchlist

Register to one stock watchlist website or software, install the app on your phone, add your selected ETF’s into the watchlist, and save.

We want the watchlist to be front an centre on your phone screen, as well as easily accessed through your tablet or computer.

Eventhough I did say you don’t need to watch it frequently, it is good to have a watchlist to determine a good time to buy, and a chance to hone your trend analysis skills

Example is IVV below, where you can buy when the trend is going down and about to flatten.

You don’t actually need to determine a good time to buy with index funds, since they are almost guaranteed to go up on the long term.

STEP 5: Calculate The Money Required

By this point in the article, you should:

- have the ETF you want to invest in

- selected a funding regime to buy the ETF

- registered to a CHESS-Sponsored brokerage with low fees

- have a watchlist setup on your computer and your phone, front and centre

To give an example, say Amalia has followed the guide and at STEP 5, this is what she had done:

- Selected IVV as the ETF to invest, ROI is ~11% per annum.

- Selected a lump sump payment of $10,000 to fund her investment one time only.

- Selected eToro as the low fee, CHESS Sponsored brokerage

- Have IVV set up in the TradingView watchlist; computer and phone.

All she needs is to come up with the money ($10,000), buy the ETF, and leave it there for years withouth touching it a.k.a “Set and Forget”

Question Time: Would that be enough to reach $1 million?

Yes, but it needs 45 years to reach that!

Probably not what she expects, BUT she can sort our her pension fund right now.

By the time she retires, she would have $1,095,302.

Dont be fooled, this is a TOP TIER pension fund performance!

HOW TO GET $1 MILLION SOONER - Attempt 1

Surely Amalia want to cash out $ 1 million sooner.

What amount she should invest? Assuming just LUMP SUM funding regime:

$20,000 invested -> 38 years

$30,000 invested -> 34 years

$40,000 invested ->31 years

$50,000 invested -> 29 years

So Amalia must increase lump sum amount to get it sooner.

But still, 29 years for a $50,000 investment, still a bit long.

Can we do better?

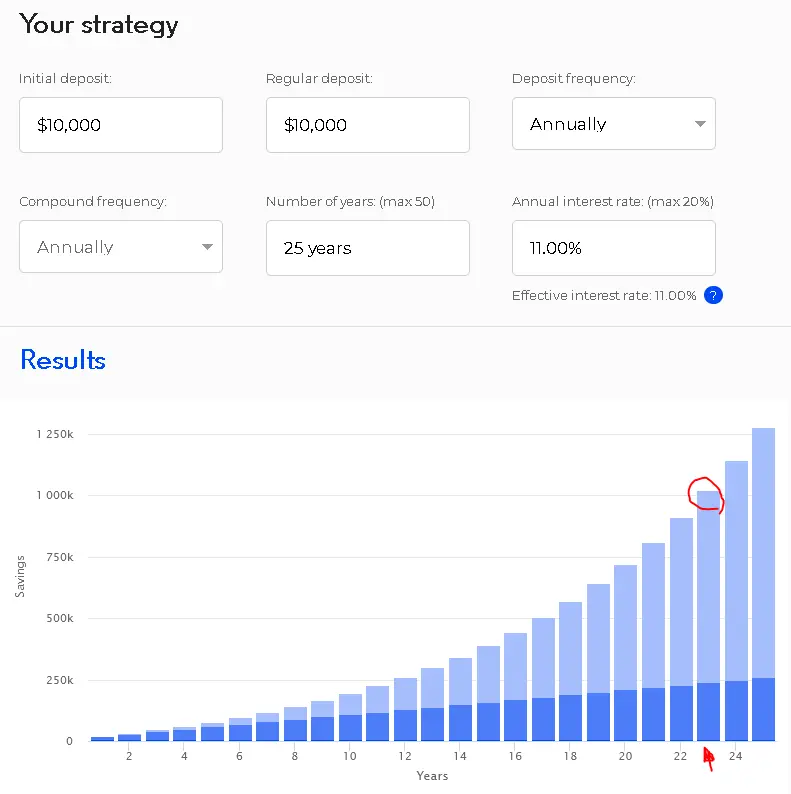

HOW TO GET $1 MILLION SOONER - Attempt 2

Let us try combining Lump Sum and regular funding regime.

Say Amalia have $10,000 lump sum, and will invest that amount every 12 months.

How long would she wait?

23 years!

HOW TO GET $1 MILLION SOONER - Attempt 3

Amalia had done the calculations, and it feels like 23 years is still too long.

She wants 1 million in 10 years. How much does she needs as a lump sum?

$400,000!

She need to have $400,000 as a lump sum to reach $ 1 million in 10 years.

FINAL STEP : Design It Your Way Using This Tool ...And Invest

You can see that this method needs time to work.

It is not for the greedy and not for people who wants quick win.

However, the results are pretty much guaranteed.

Use this method as a part of your investment tool belt.

Play around with this calculator>> to see the amounts you can afford to commit, what interest rate needed to give you $1 million, and the timeframe that you want.

You will quickly find out that the interest rate majorly dictates how fast you can get that $1 million.

If you require greater than 20% interest rate, unfortunately you have to move from index funds to other investment instruments.

That is why I developed SFA Investment Class.

A one-year guided class and mentorship in which my students learn about all of the investment instruments, including their returns and how to manage them.

In the program, I give :

- In-depth stock investment knowledge that leaves no stone unturned.

- One-on-one mentoring that guides my students through the entire process.

- Action Plans for applying what my student’s learned to real-world investments.

- Practical Tips.

- Weekly updates of current economic and investing insight.

I also put my students in a private Whatsapp group where they will meet others in the same situation as them, as well as having direct access to mentors and group discussions.

I like to promote the spirit of camaraderie in investments, as I feel is few and far between in the industry.

Some of my students now are doing investment together where they analyze different stocks from multitudes of industry, collate the analysis, rank the top performance, and invest there. Its great to see.

Anyways, if the above program fits you, I would like you to be part of the team>>

I guarantee that within the first two months, you will feel far more confident about your investments, and have a solid plan in place to achieve your financial objectives.

Either I’see you in the class, or in the next article.

Until then..

James Lim

SFA Founder

Member of Australian Investors Association (AIA)

The University of Queensland Speaker